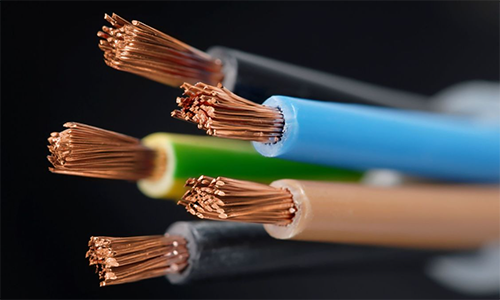

Copper is one of the most crucial industrial metals, often referred to as the "metal of electrification" due to its wide application in electrical wiring, construction, and renewable energy systems. Its price is a vital indicator of global economic health, given its extensive use across industries.

Factors Influencing Copper Prices

Supply and Demand:

Industrial Demand: Economic growth in industrialized nations or rapid development in emerging economies drives copper demand, especially in construction, automotive manufacturing, and electronics.

Supply Constraints: Disruptions in major copper-producing regions (e.g., Chile, Peru) due to strikes, political instability, or natural disasters can tighten supply and push prices upward.

Economic Trends:

Copper prices often correlate with global economic trends. A booming economy typically increases demand, while a slowdown leads to reduced consumption.

Technological Innovations:

Growth in renewable energy sectors, such as solar power and wind energy, and the shift to electric vehicles have increased copper demand.

Innovations in recycling and alternative materials can also impact the demand for mined copper.

Energy Costs:

Mining and refining copper are energy-intensive processes. Fluctuations in energy prices directly affect production costs and, consequently, copper prices.

Market Speculation:

Commodities traders and investors speculate on copper futures, causing short-term price fluctuations based on market sentiment, geopolitical developments, or monetary policies.

Recent Trends in Copper Prices

Surge in Renewable Energy Projects: Countries prioritizing clean energy have spurred demand for copper, particularly in regions aiming for net-zero carbon emissions.

Economic Recovery Post-Pandemic: Industrial activity rebounding in major economies has led to a steady increase in copper consumption.

China's Role: As the largest consumer of copper, China's economic policies and infrastructure investments significantly influence global prices